Deciding On No-Fuss Systems In College Admissions Essay

30/12/2019Dog Collars Experiment: Good or Bad?

31/12/2019The term entered will cause only accounts which have element gadgets for the desired term and class to be included or excluded. When the Selection Term is entered and an account is processed, all detail objects for the chosen term will be printed. When not utilizing a Detail Category hierarchy, the Selection Term may be left blank. When blank, solely element objects with a refundable steadiness might be printed. If you filed a whole and accurate tax return, your refund should be issued inside 21 days of the obtained date.

Check the status of your refund:

You ought to count on your refund across the finish of the month or first week of March. Does this chart have the correct dates for those submitting with the EIC, or no? I e-filed Jan. 30, and it was accepted that day, so according to this chart we should expect our refund Feb. 17, which is a Saturday, also, not 21 days. I filed my taxes on the 31st of Janurary.

Spdate Experiences

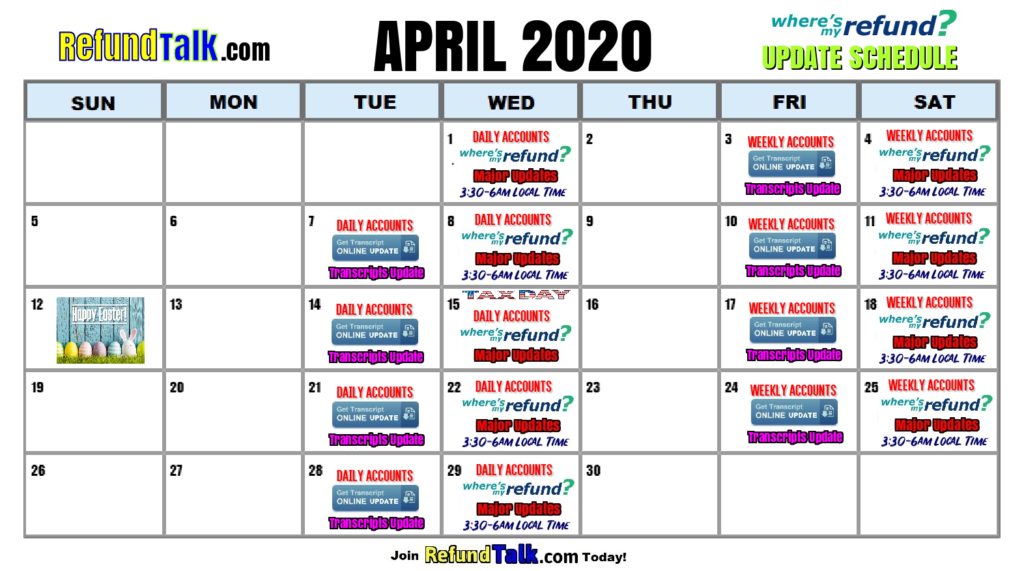

The IRS often sends out refunds on a schedule. This schedule, then again, varies by the approach you sent your return in, whenever you file, in addition to what credits you claim. Here is a projected schedule in the chart beneath.

I filed on February twenty sixth and I checked it at present and it says Your tax return is still being processed. I did have the EIC and Child Credit.

One must take note that taxes are due on Wednesday, April 15, 2020. If in case you did not file your return before the deadline, then you would be charged late filing fees and different penalties. But, on the identical time, when you need extra time, then there’s good news for you, as you can file a request for an extension with the IRS.

If you have EITC, the law says the IRS can not course of your return until 2/15. So although you filed early, the IRS simply spdate held your return and didn’t do anything with it. Now, you’re waiting 21 days from 2/15 – which places you round March 4 to get your refund.

Fall 2019 Refund Calendars

Once funds credit score to your account, Delgado should request the funds from the Department of Education to pay a Pell Grant, FSEOG, or Direct Loan. This multi-day course of can be impacted by weekends and holidays. After the above dates, once your account exhibits a credit balance, you possibly can anticipate to obtain your refund roughly 14 days from the date the credit score posted.

These anti-fraud protections need to be revised every year as a result of perpetrators have gotten more adept at refund fraud. Processing returns and distributing refunds safely and efficiently is a key goal of ours. The timing of a refund is determined by when and how a return is filed. Refund updates won’t be available for these filers until their processing time begins in late February. Unfortunately, the complete refund is held even when solely part of it’s allotted to the earned revenue tax credit or additional child tax credit score.

I did not add my location on my Spdate profile, how does the site know where I live?

I called back and spoke to a person who then told me a letter was actually dated three/9 but wouldn’t specify why our refund was being held even after I informed him I had already spoken to somebody earlier. I e-filed my return on 02/09/2020 and it was accepted that day itself. Status showed Return Received for subsequent 2 to three days and became tax matter 152 and it nonetheless remains the identical.

More than 12 Weeks Since You Filed? If you mailed the returnmore than 12 weeks agoand have not acquired your refund or another correspondence from DRS about your return, please contact DRS during enterprise hours at . It could be very useful to file your taxes early because it consists of many advantages for helping you through the tax season. These also consist of decreasing stress, having more time to pay when you owe cash on your taxes as well as getting your refund earlier and quicker. For checking your refund standing, all you have to have is the Social Security number or ITIN shown in your tax return, your submitting standing and your actual refund amount.